Table Of Content

Simply log into the Account Center and select a new design for yourself or anyone on your account. There's no application to fill out or financial information to provide. The hardest card to get is determined by your own personal circumstances. In general, ultra-premium cards (often identified by annual fees of $400 or more) require excellent credit history, which can make them challenging to get. If you have a high credit score, it’s possible that other factors influence your odds of approval. For example, some issuers limit how many cards you can get within their product umbrella or based on your recent credit inquiries.

Delta Reserve and Reserve Business card benefits

A dedicated team of CreditCards.com editors oversees the automated content production process — from ideation to publication. These editors thoroughly edit and fact-check the content, ensuring that the information is accurate, authoritative and helpful to our audience. Deferred interest plans are often advertised in retail stores as charging “no interest until” a certain date.

Best Offers

Here is the must-have card for Apple fans, especially those who spend heavily with Apple Pay. The innovative security and debt management features and lack of the usual despised fees make this a fresh and unique addition to your financial toolkit. Android users and those looking for a sign-up bonus or travel rewards program should look elsewhere. For moderate spenders who are willing to activate the 5% rotating categories and track the quarterly spending cap, this no-annual-fee card can deliver tidy rewards outside of its ongoing 1% earning rate.

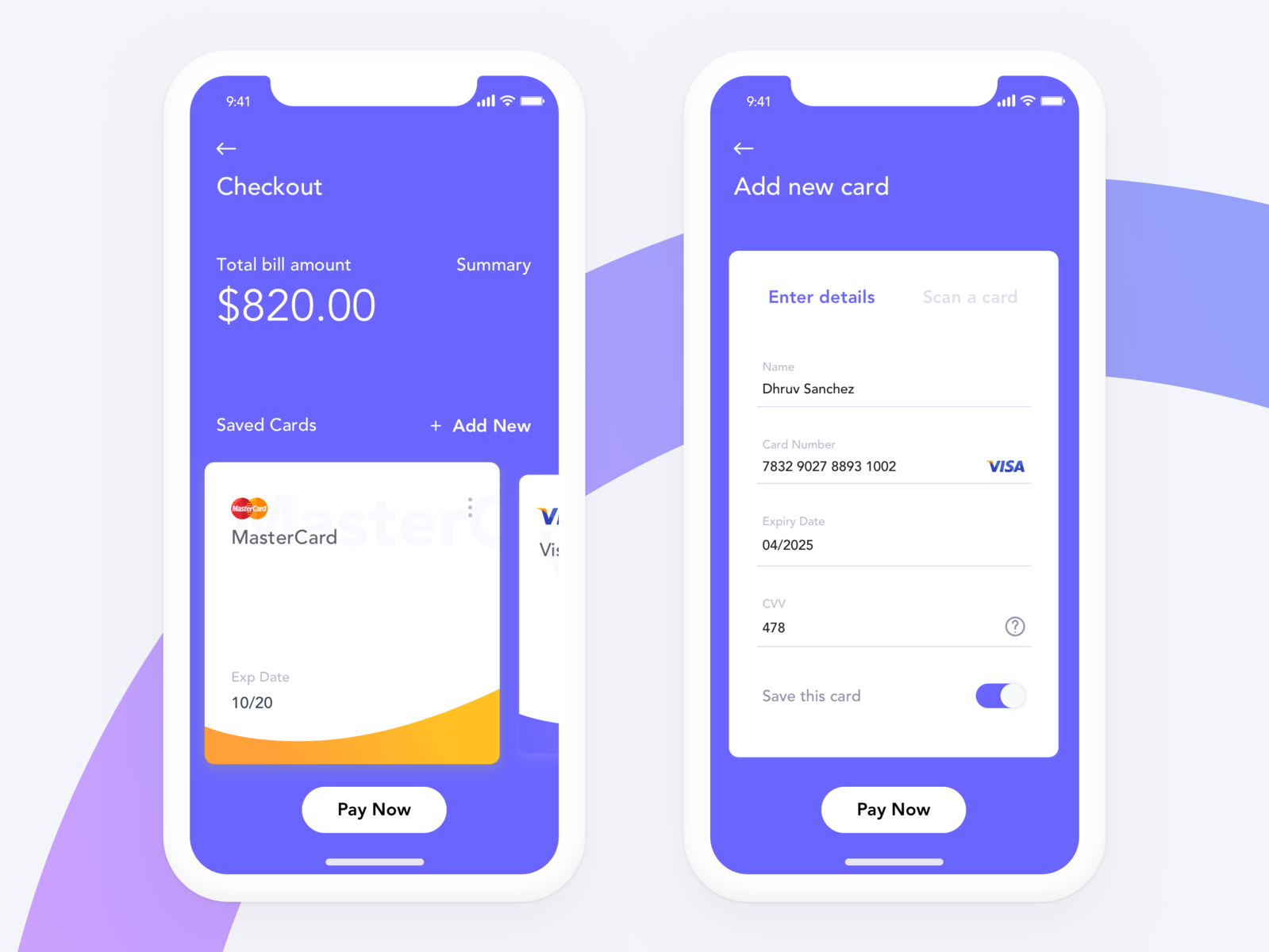

Designing payment experiences that stand out

These brands compensate us to advertise their products in ads across our site. This compensation may impact how and where products appear on this site. We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products. Sometimes, you can choose your credit card customization as part of the initial application process, such as if you’re getting a credit card for the first time. In other cases, you’ll need to log in and verify your account in order to get a personalized credit card. These days, there are several cards made out of metal which keep your credit card strong and less prone to wear and tear.

Financial Safety

We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the credit card methodology for the ratings below. The national corporate regulator has issued a permanent ban on the use of Centrepay by outback retailer Urban Rampage, after finding the credit tool was causing financial harm to First Nations customers.

Select a card product based on your target customer base – whether they are affluent customers with a strong credit history or young adults who are just starting out. Visa offers different types of card products based on the region. CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores.

Wells Fargo spokeswoman Sarah DuBois said the option to personalize cards with custom images has been popular with customers. Since 2009, “more than 8 million cardholders have customized the look of their cards using the Card Design Studio service.” Wells Fargo also offers a library of images you can choose from to personalize your card. Delta Reserve cardmembers receive a head start of 2,500 Medallion Qualification Dollars each qualification year. They also earn MQDs at a rate of 1 MQD per $10 in eligible purchases charged on their card — the highest earning rate of any Delta American Express card. For those new to the Delta Amex cards, know that the Delta Reserve Card and the Delta Reserve Business Card are two of the most premium cards within the suite of Delta cobranded credit cards.

But because of TD Bank’s relatively small footprint, you're eligible to open an account only if you live in one of a handful of states. It's possible to find similar cards with lucrative rewards and features, without geographic restrictions. As you might guess, it's not easy to repurpose material from a 747 aircraft and turn it into a credit card. American Express cards are typically made from stainless steel and polymer to maintain durability and function.

Discover cards come with relatively bland card motifs, but make up for it by letting cardholders personalize their look with a choice of numerous designs. With the Discover it® Cash Back, you can choose your preferred image to print on the front of the card and earn up to 5% cash back on select purchases. A growing number of credit and debit card companies are allowing their most style-conscious customers to choose from an array of fashionable designs – or customize their credit cards themselves by uploading their own photos.

Find out what credit card designs Discover offers and how you can easily change the design of your card. If you are the design lover you should see these credit card designs presented for your inspiration. You can make your credit card your own with the right custom credit card design.

Quiz! Which Disney Visa Credit Card Design Are YOU? - AllEars.Net

Quiz! Which Disney Visa Credit Card Design Are YOU?.

Posted: Wed, 29 Nov 2023 08:00:00 GMT [source]

The new design comes after recent enhancements made to the Delta SkyMiles American Express Cards to improve the travel experience and deliver everyday value to Members, both in the air and on the ground. For Synchrony HOME Partners that accept the card online look for the option to pay with a Synchrony HOME Credit Card on the payment page. Enter your Synchrony HOME Credit Card account number when prompted. Credit cards are one of the best financial tools you have at your disposal, if used correctly.

All Wells Fargo Credit Cards are subject to credit qualification. Let’s face it — there’s a lot of jargon and high-level talk in the credit card industry. Our experts have learned the ins and outs of credit card applications and policies so you don’t have to. With tools like CardMatch™ and in-depth advice from our editors, we present you with digestible information so you can make informed financial decisions.

Discover is a top credit card issuer that offers extensive customization options. There are more than 150 different card designs to choose from, depending on which card you own. Many of the top credit card and debit card issuers let customers have fun with their card designs. Here’s some of your best options for credit card personalization. If you want to use your credit card as a way to express yourself, some credit card issuers allow you to customize the design of your card. Depending on the issuer, you might be able to choose between a set of options, while others will allow you to upload an image of your choosing to serve as the face of your credit card.

That way, when you’re using a credit card, it can become a conversation starter rather than simply a way to pay for purchases. You may have noticed that many credit cards use blue in their primary color scheme. Brands including Chase and American Express have blue in their logos, so it’s logical for them to carry those colors over to some cards. Other brands may use blue simply out of preferred design aesthetic. It’s thought that blue extends a feeling of trust and loyalty, which might be another reason many credit cards are blue. Choosing a card solely for its looks isn’t a wise financial decision.

In addition to the limited-edition look and feel of the card, new Delta SkyMiles Reserve cardmembers can also earn 60,000 bonus miles after spending $5,000 on purchases on the card in the first six months of card membership. These days, Capital One does all of the hard work for you but if you’re more of a do-it-yourself type of person, you still have options. GOBankingRates works with many financial advertisers to showcase their products and services to our audiences.

✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit. While an authorized user can sometimes get a custom card, it will usually have to be managed through the primary cardholder. Policies differ by card issuer, so check with the primary cardholder and/or issuer to see what might work for you. There are particular credit card requirements and steps that you should follow when trying to get a customized credit card.

No comments:

Post a Comment